Life moves fast — your card should keep up.

Wing Bank Mastercard gives you the freedom to shop, spend, travel, and enjoy exclusive benefits worldwide.

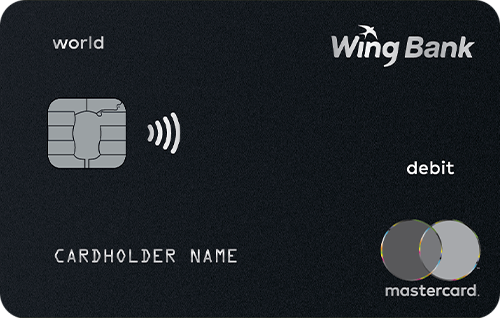

All cards feature a numberless design for enhanced security and can be fully managed via the Wing Bank App.