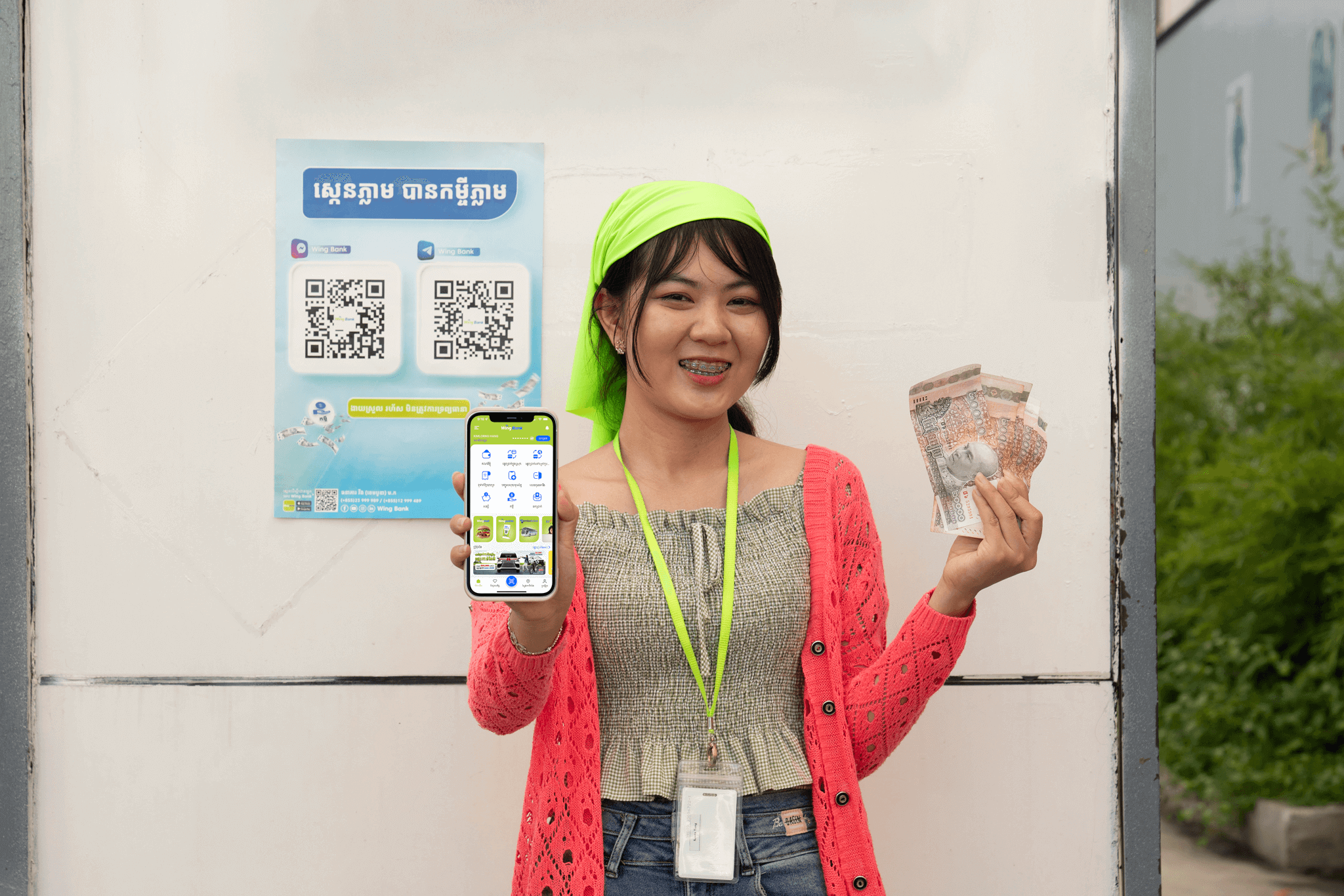

Share and Earn with Wing Bank’s Digital Loan

December 5, 2023Refer Wing Bank’s Digital Loan to friends and family, be their financial support, and reap incredible rewards.

Wing Bank (Cambodia) Plc has unveiled a referral program for its digital loan—an innovative financial solution designed to deliver immediate support to individuals requiring urgent financial needs. This program empowers participants to help friends and family while earning rewards for their invaluable support.

Financial emergencies can arise unexpectedly, leaving individuals and families in need of immediate financial assistance. Wing Bank recognizes the significance of community support during such challenging times and aims to foster an environment where individuals can actively contribute to the financial well-being of their friends, family members and loved ones.

“Financial challenges should never hinder one’s dreams and aspirations,” said Han Peng Kwang, CEO of Wing Bank. “At Wing Bank, we are committed to breaking down barriers and providing access to financial solutions.”

By introducing the person in need to our innovative financial solution, they not only address their loved ones’ needs but also reap rewards for themselves. It is a win-win situation that highlights the power of community support,” he added.

With the Wing Bank’s Digital Loan referral program, individuals can have the opportunity to introduce their loved ones, who are in need of immediate financial assistance, to the convenient and accessible loan solution provided by the user-friendly Wing Bank App. By successfully referring new users who apply and qualify for a loan, individuals can earn a commission fee of 4,000 Riel for each successful referral.

The commission fee is credited directly to the referrer’s Wing bank account early of the following month, granted they have used their Wing Bank account as the referral code. However, commission fee will be awarded exclusively for new users of Wing Bank’s Digital Loan. Therefore, referring existing users to apply for digital loans will not be eligible for this particular benefit.

“With our innovative digital loan, individuals can make a difference in their community by introducing their friends and family to a convenient and user-friendly financial solution. Together, we can create a powerful network of support,” said Doeuk Daravuth, Wing Bank’s Digital Lending Business Director.

Wing Bank’s Digital Loan offers a state-of-the-art instant service prioritizing customer convenience, speed, and safety. Users can apply anytime, anywhere, without complicated paperwork, and the loan disbursement takes only two minutes. This eliminates the need to visit a physical branch and reduces the waiting period from weeks to instant access.

Users can be eligible for loans up to USD 50,000 with a competitive interest rate and a repayment term of up to three years. Users of the Wing Bank App, including Wing KHQR, those receiving payroll through the app, and Wingmall users, are eligible without the need for collateral or guarantors. The more transactions users conduct through the Wing Bank App, the higher their eligibility for loan amounts.

To apply for Wing Bank’s Digital Loan, customers have several options available, they can use the Wing Bank App, or simply scan the QR Code displayed at Wing locations throughout the country.